She opened a separate bank account — what do I do?

6 min read

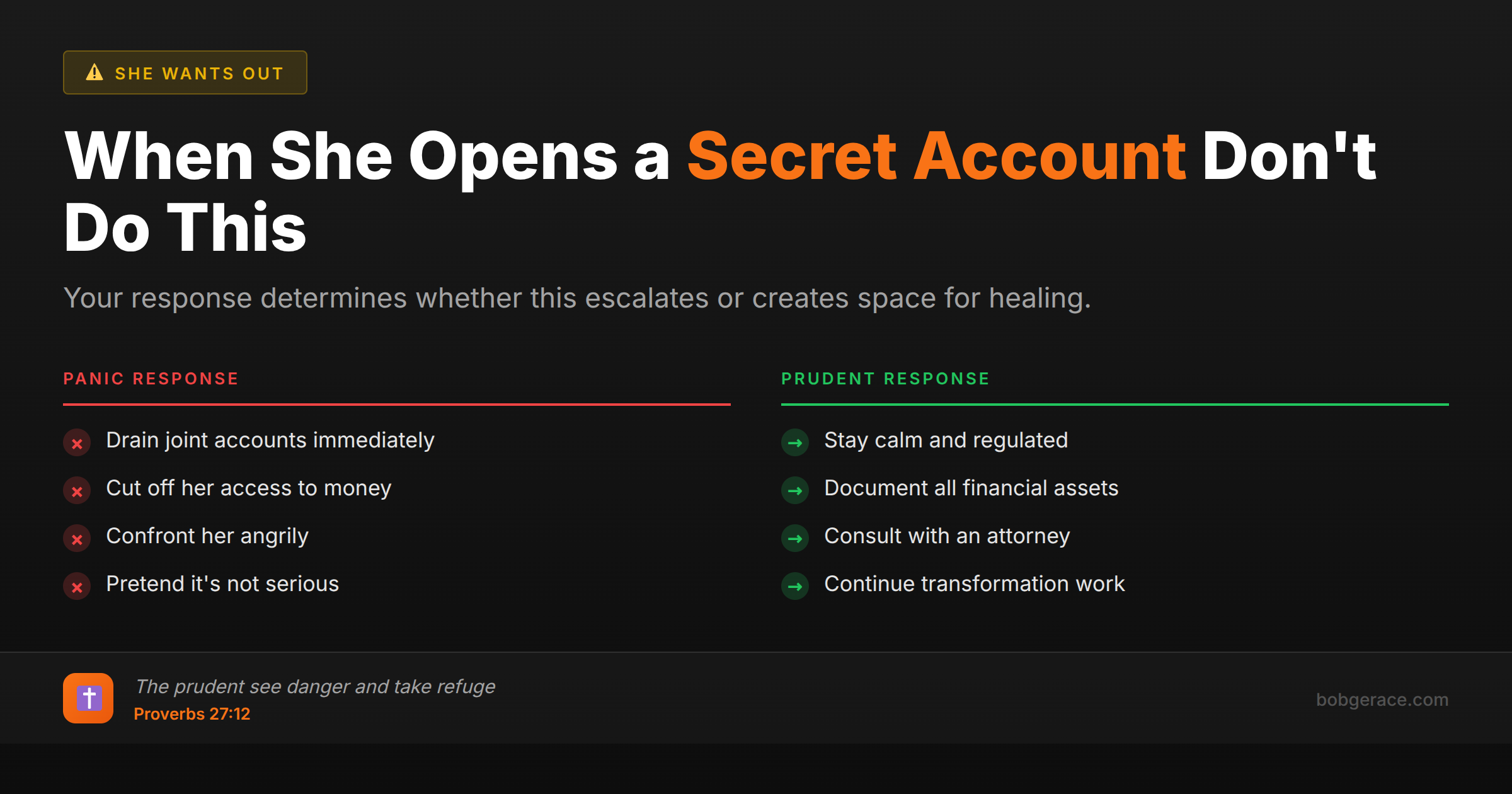

A separate bank account is a protection move. She's preparing for the possibility of divorce by establishing financial independence. This doesn't mean divorce is certain, but it means she's serious about having options. Your response: don't panic, don't retaliate, but do take your own protective steps. Document shared assets. Understand your financial picture. Consult an attorney about protecting yourself. And continue your transformation work — because financial moves, while significant, don't change the core strategy.

The Full Picture

Discovering she's opened a separate bank account hits hard. It feels like betrayal — a concrete step away from the partnership you thought you had.

What this typically means:

She's preparing for independence. Whether she's certain about divorce or just wants options, she wants financial capability that doesn't depend on you or your joint accounts.

She's protecting herself. She may fear (rightly or wrongly) that you could limit her access to money during a separation or divorce. Her own account gives her security.

She's taking advice. Almost every divorce attorney and women's support organization advises women to establish independent finances early. She's likely following guidance.

What it doesn't necessarily mean:

- That she's hiding assets (though she might be) - That divorce is inevitable - That she's acting in bad faith - That reconciliation is impossible

Your response:

Don't retaliate financially. Draining joint accounts or cutting off her access will escalate conflict, damage trust, and often looks terrible in court.

Do protect yourself appropriately. Consult an attorney about what protective steps are reasonable. You may want to ensure you also have access to funds, document shared assets, and understand the financial picture.

Don't confront aggressively. Demanding explanations or accusing her of betrayal rarely helps. If you need to address it, do so calmly: 'I noticed you opened a separate account. Can we talk about what that means for us?'

Do continue your primary work. Financial moves are part of the landscape now. But your core strategy — transformation, regulated presence, maintaining connection where possible — doesn't change.

What's Really Happening

Financial separation often represents what psychologists call 'exit planning' — concrete preparation for the end of a relationship. It's significant because it moves from emotional decision to practical action.

The stages of exit:

Research identifies several stages people go through when leaving a relationship:

1. Private contemplation — thinking about leaving 2. Confidant involvement — telling trusted others 3. Practical preparation — steps like opening accounts, consulting attorneys 4. Public declaration — announcing the decision 5. Execution — filing, moving out, etc.

Opening a separate account is typically stage 3. It's further along than contemplation but not yet at the point of no return.

What this means for you:

She's serious enough to take concrete steps. But people sometimes take preparatory steps and then reverse course. The account doesn't lock in the outcome.

The psychological trap for you:

Discovering hidden financial moves triggers betrayal response — the sense of being deceived, of partnership violated. This can push you toward either aggressive confrontation or defeated withdrawal.

Both are counterproductive. Aggressive confrontation confirms her fears that she needs protection from you. Defeated withdrawal signals that you've given up.

The regulated response: acknowledge the reality, take appropriate protective steps, and continue the relational work. You can feel hurt by this move without being controlled by that hurt.

What Scripture Says

Proverbs 27:12 says 'The prudent see danger and take refuge, but the simple keep going and pay the penalty.'

She's being prudent — from her perspective. She sees danger and is taking refuge. You can disagree with her perception while still recognizing the logic of her action.

Your call is also to prudence. 'The simple keep going' — ignoring the financial reality, pretending it doesn't matter — leads to penalty. See the danger. Take your own appropriate refuge.

Matthew 5:25 offers practical wisdom: 'Settle matters quickly with your adversary who is taking you to court.' The context is legal, but the principle is broader: deal with practical matters wisely before they become bigger problems.

Don't ignore the financial dimension. Don't retaliate with financial aggression. Do take measured, prudent steps to understand and protect the marital estate.

1 Timothy 5:8 reminds that provision for one's household is a serious responsibility. Your financial decisions affect not just you but potentially your children. Steward wisely.

Prudence isn't paranoia. It's wisdom. Handle finances with the same regulated wisdom you're developing in every other area.

What To Do Right Now

-

1

Don't panic or retaliate. Draining accounts or cutting off access will escalate badly. Stay regulated.

-

2

Document the current financial picture. Make copies (or screenshots) of all account statements, debts, assets, income records. Know what exists.

-

3

Consult an attorney about appropriate protective steps. What you can and should do varies by state and circumstance.

-

4

Ensure you have access to adequate funds. This may mean opening your own account or ensuring joint accounts remain accessible. Discuss with your attorney.

-

5

Don't hide assets or make large purchases. These look terrible in court and may be clawed back. Stay above board.

-

6

If you address it with her, stay calm. Curiosity, not accusation: 'I noticed you opened a separate account. Can we talk about where we are and what this means?'

Related Questions

Navigate Financial Complexity Wisely

Financial moves add complexity to an already difficult situation. Let me help you respond wisely without making things worse.

Get Practical Guidance →