She opened a separate bank account

6 min read

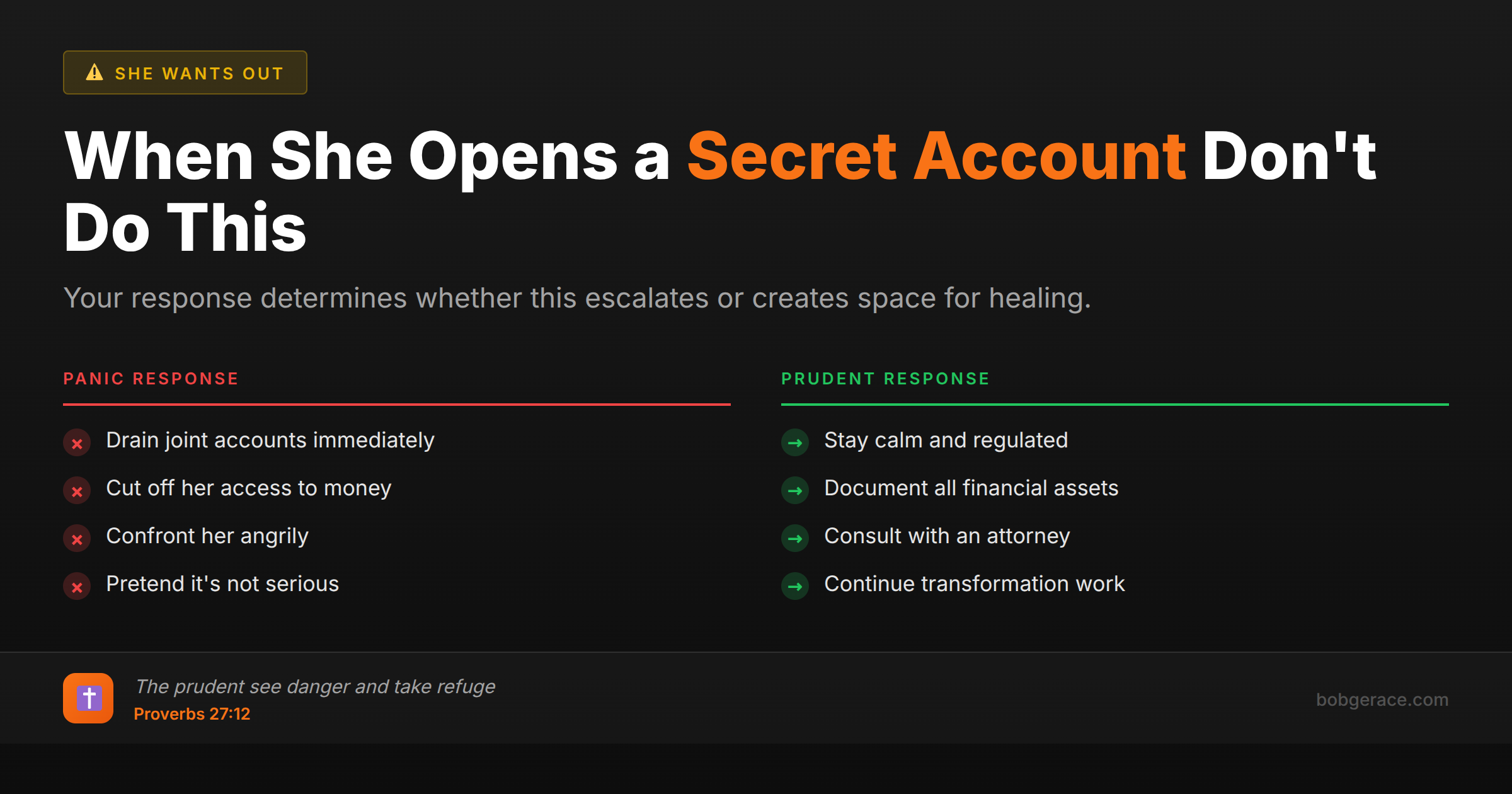

When your wife opens a separate bank account without discussing it with you, she's sending a clear message: she no longer trusts you with shared financial decisions, or she's preparing for life without you. This isn't necessarily about the money itself - it's about autonomy, control, and often, exit planning. Your gut reaction might be anger or panic, but how you respond right now determines whether this becomes a pathway back to trust or accelerates her departure. The separate account is a symptom, not the disease. She's protecting herself because somewhere along the way, she stopped feeling safe - financially, emotionally, or both. The question isn't how to get her to close that account. It's how to become the kind of husband she wants to build a financial future with again.

The Full Picture

A separate bank account represents a fundamental shift in your wife's mindset. She's moved from 'we' to 'me' in her financial thinking. This doesn't happen overnight - it's the result of accumulated frustration, broken trust, or feeling powerless in financial decisions.

Common triggers include: • Feeling excluded from major financial decisions • Discovering hidden purchases or debts • Being criticized or controlled about her spending • Earning her own income and wanting autonomy • Preparing for potential separation or divorce

The separate account gives her something she felt was missing: control and security. Maybe you made unilateral decisions about investments. Maybe you criticized her purchases while making your own freely. Maybe she discovered debt you hadn't disclosed. Or maybe she simply wants the dignity of managing some of her own money.

Here's what most men get wrong: They focus on the account itself rather than what drove her to open it. They demand access, argue about transparency, or worse - try to control her access to money. This only confirms her fears and pushes her further away.

The deeper issue is that financial intimacy - like physical intimacy - requires trust, communication, and mutual respect. When a wife opens a separate account, she's telling you that financial intimacy has broken down. She no longer feels safe being financially vulnerable with you.

Some women open separate accounts as a form of self-protection while working on the marriage. Others do it as preparation for leaving. The difference usually comes down to how you respond and what changes you're willing to make.

What's Really Happening

From a therapeutic standpoint, separate bank accounts in a previously joint-finance marriage represent a shift in attachment security. When partners feel secure in their relationship, they naturally move toward financial interdependence. Separating finances is often a protective response to feeling financially vulnerable or powerless.

Research shows that financial disagreements predict divorce more strongly than most other marital conflicts because money represents deeper issues: trust, power, values, and future planning. When a spouse opens a separate account without discussion, they're essentially saying the financial system in the marriage isn't working for them.

Three primary psychological drivers emerge:

Financial trauma response: If she grew up in financial chaos or has experienced financial abuse, separate accounts provide a sense of security and autonomy that feels essential for emotional safety.

Power rebalancing: In marriages where one partner has dominated financial decisions, the other may seek separate accounts to restore a sense of personal agency and dignity.

Exit preparation: Sometimes separate accounts indicate emotional detachment and practical preparation for independence.

The key clinical indicator is whether this action was discussed or hidden. Secret accounts suggest deeper trust issues and often correlate with emotional withdrawal from the marriage. However, even openly maintained separate accounts can indicate a fundamental shift in how she views the marital partnership.

From an attachment perspective, this behavior often reflects anxious or avoidant responses to perceived threats to security or autonomy within the relationship.

What Scripture Says

Scripture presents marriage as a profound unity, including financial partnership. Genesis 2:24 tells us, "Therefore a man shall leave his father and mother and hold fast to his wife, and they shall become one flesh." This oneness extends beyond the physical to include our resources and financial stewardship.

However, 1 Peter 3:7 instructs husbands to live with their wives "in an understanding way, showing honor to the woman as the weaker vessel, since they are heirs with you of the grace of life." This isn't about capability - it's about protecting and honoring your wife's dignity and autonomy, even in financial matters.

Ephesians 5:25 commands, "Husbands, love your wives as Christ loved the church and gave himself up for her." If your wife felt the need to open a separate account, ask yourself: Have you been loving her sacrificially in your financial decisions? Have you been giving yourself up for her good, or pursuing your own financial preferences?

Proverbs 31:11 says of the virtuous woman, "The heart of her husband trusts in her, and he will have no lack of good." Notice it's the husband trusting the wife with resources, not controlling them. The Proverbs 31 woman manages money, makes investments, and conducts business - all with her husband's trust and support.

Luke 16:10-11 reminds us, "One who is faithful in a very little is also faithful in much... If then you have not been faithful in the unrighteous wealth, who will entrust to you the true riches?" Your faithfulness in financial partnership with your wife reflects your spiritual maturity and readiness for greater kingdom responsibility.

The goal isn't forced financial unity - it's earning back the trust that makes unity desirable to her again.

What To Do Right Now

-

1

Stop any attempts to control, monitor, or demand access to her separate account - this will only confirm her need for it

-

2

Have an honest conversation asking (without anger) what led her to feel she needed financial independence

-

3

Listen without defending yourself - her feelings about financial safety are valid even if you disagree with her reasoning

-

4

Review your past financial decisions and acknowledge specific times you excluded her or made unilateral choices

-

5

Demonstrate trustworthiness in small financial matters - follow through on budgets, discuss purchases, keep promises about money

-

6

Create a new financial framework together where she has both security and autonomy within the marriage partnership

Related Questions

Don't Let Financial Separation Become Permanent Separation

When your wife starts separating finances, you have a window of opportunity to address the deeper issues. Don't navigate this alone.

Get Help Now →