What do I do about finances immediately?

6 min read

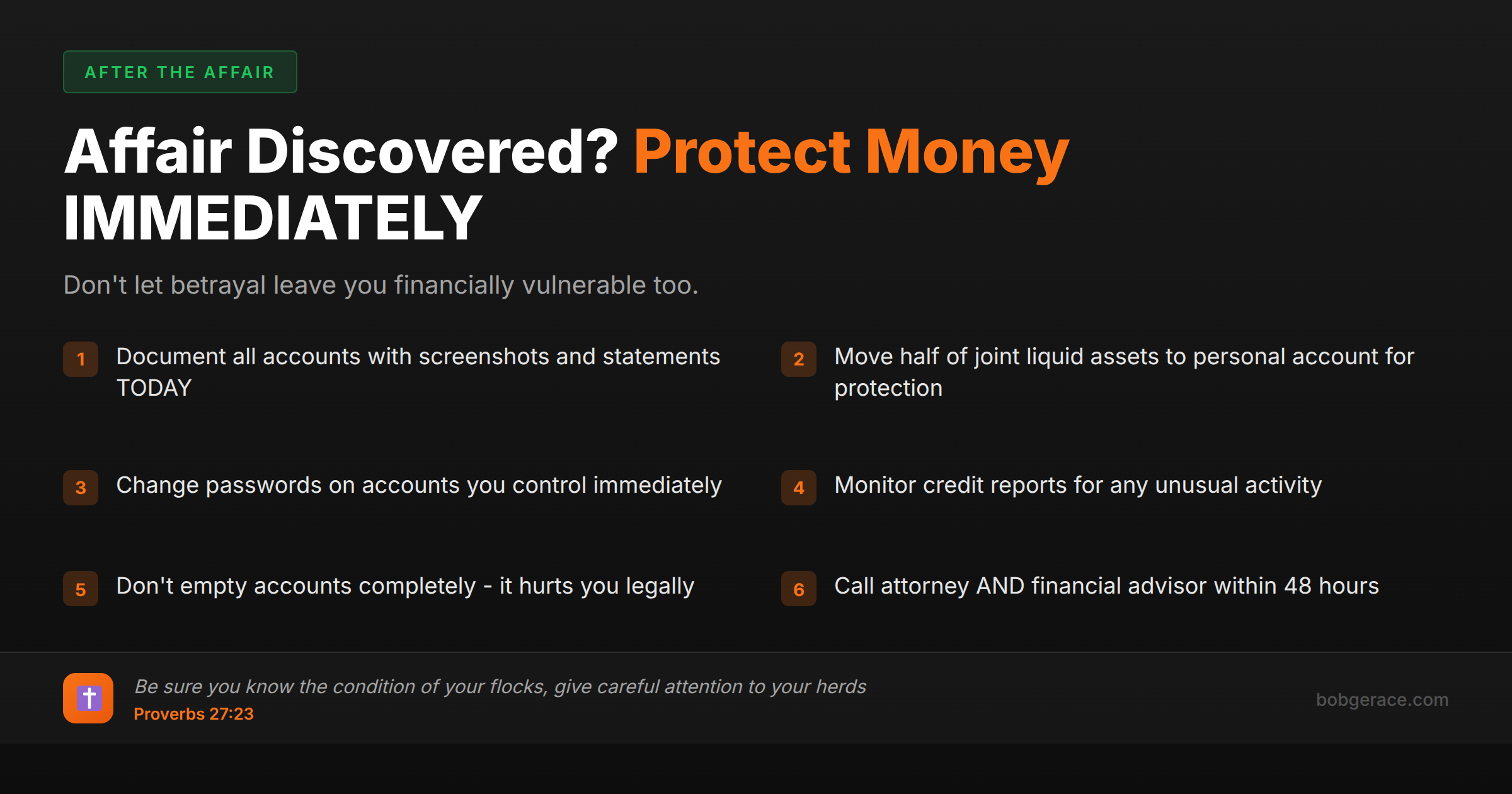

When you discover your spouse is involved with another man, protecting your finances immediately is crucial. First, secure half of your joint accounts by moving funds to a personal account - not to hide money, but to prevent being left financially vulnerable. Document all assets, debts, and financial accounts by taking screenshots and gathering statements. Change passwords on any accounts you control and monitor credit reports for unusual activity. Don't make rash decisions like canceling credit cards or emptying accounts completely, as this can hurt you legally later. Instead, focus on creating financial transparency and protection. Consult with both an attorney and a financial advisor within days, not weeks. Remember, this isn't about punishment or revenge - it's about responsible stewardship of your family's resources during an unstable time.

The Full Picture

Financial chaos often accompanies marital betrayal, and you need to act quickly but wisely. When your spouse is emotionally and potentially financially invested in another relationship, your family's financial security becomes vulnerable in ways you might not immediately recognize.

The immediate risks are real and varied. Your spouse might be spending marital funds on this other relationship - dinners, gifts, trips, or even larger expenses you're unaware of. They might be making financial decisions without your knowledge or consent. In their emotional state, they could make impulsive choices that affect your shared assets, retirement accounts, or business interests.

Documentation becomes your foundation. Take screenshots of all account balances, gather recent statements, and create a comprehensive list of all assets and debts. This includes bank accounts, investment accounts, retirement funds, real estate, vehicles, business interests, and even valuable personal property. Don't forget about life insurance policies, which often get overlooked.

Protection doesn't mean aggression. Moving half of joint funds to a personal account isn't about hiding money - it's about ensuring you can pay bills, handle emergencies, and maintain stability for any children involved. Courts generally view this as reasonable protection rather than financial misconduct, provided you're transparent about it.

Professional guidance is essential. An attorney can explain your legal rights and obligations, while a financial advisor can help you understand the immediate and long-term implications of various financial decisions. A forensic accountant might be necessary if you suspect hidden assets or undisclosed spending.

Think long-term, act strategically. Every financial move you make now will be scrutinized later, whether in reconciliation discussions or legal proceedings. Act with integrity, document everything, and focus on protection rather than punishment.

What's Really Happening

From a clinical perspective, financial anxiety during marital crisis creates a secondary trauma that often goes unaddressed. When someone discovers their spouse's affair, the immediate fear isn't just about the relationship - it's about survival, security, and the unknown. This financial stress can actually impair your decision-making ability just when you need clarity most.

The betrayed spouse often experiences what we call 'hypervigilance' - an exhausting state of constant alertness to potential threats. This extends to finances, where every transaction becomes suspect, every account needs monitoring. While some level of financial awareness is absolutely necessary, excessive monitoring can become consuming and prevent you from addressing the deeper emotional work needed.

I've observed that clients who take swift, organized financial action in the first few days actually experience less anxiety long-term. There's something psychologically stabilizing about knowing your immediate needs are secure. This isn't about control or revenge - it's about creating a foundation of safety that allows you to //blog.bobgerace.com/christian-marriage-death-protocol-kill-old-patterns/:process the emotional trauma without the constant fear of financial ruin.

However, be aware of the temptation to use financial control as emotional leverage. Some clients attempt to 'punish' their spouse through financial restrictions, which ultimately backfires both legally and relationally. The goal is protection and transparency, not retaliation. Remember, if reconciliation is your desired outcome, every action you take now affects that possibility.

What Scripture Says

Scripture provides clear guidance on financial stewardship and wisdom during crisis. Proverbs 27:23-24 instructs us to "Be sure you know the condition of your flocks, give careful attention to your herds; for riches do not endure forever, and a crown is not secure for all generations." This isn't just about livestock - it's about being aware of and responsible for the resources God has entrusted to you.

Luke 14:28 reminds us, "Suppose one of you wants to build a tower. Won't you first sit down and estimate the cost to see if you have enough money to complete it?" Financial planning and awareness aren't worldly concerns - they're biblical responsibilities. You need to understand your financial position to make wise decisions about your future.

1 Timothy 5:8 states, "Anyone who does not provide for their relatives, and especially for their own household, has denied the faith and is worse than an unbeliever." This provision includes protecting existing resources, not just earning new ones. Securing finances isn't selfishness - it's biblical stewardship.

Proverbs 21:5 teaches that "The plans of the diligent lead to profit as surely as haste leads to poverty." Quick, strategic action based on wisdom differs from hasty emotional reactions. Take time to plan your financial moves, but don't delay necessary protection.

Remember Matthew 10:16: "Be as shrewd as snakes and as innocent as doves." Wisdom in financial matters doesn't compromise your Christian character. You can be both protective and loving, both wise and gracious.

What To Do Right Now

-

1

Document everything today - Take screenshots of all account balances, gather recent statements, and create a comprehensive asset inventory including bank accounts, investments, retirement funds, real estate, vehicles, and valuable personal property

-

2

Secure reasonable protection - Move approximately half of joint liquid assets to a personal account for legitimate expenses and emergency needs, ensuring you maintain detailed records of all transfers

-

3

Monitor and secure access - Change passwords on accounts you personally control, check credit reports for unusual activity, and consider placing fraud alerts with credit bureaus

-

4

Consult professionals immediately - Schedule appointments within 48-72 hours with both a family law attorney and a financial advisor to understand your rights, obligations, and options

-

5

Establish financial boundaries - Don't cancel joint credit cards or make large financial decisions without legal counsel, but do monitor accounts daily for unusual spending patterns

-

6

Create emergency protocols - Ensure you have access to funds for immediate needs like housing, utilities, food, and children's expenses, while maintaining complete transparency about your financial actions

Related Questions

Don't Navigate This Financial Crisis Alone

Protecting your family's financial future while preserving the possibility of restoration requires expert guidance. Let me help you make wise decisions during this critical time.

Get Help Now →