What financial protections should I put in place?

5 min read

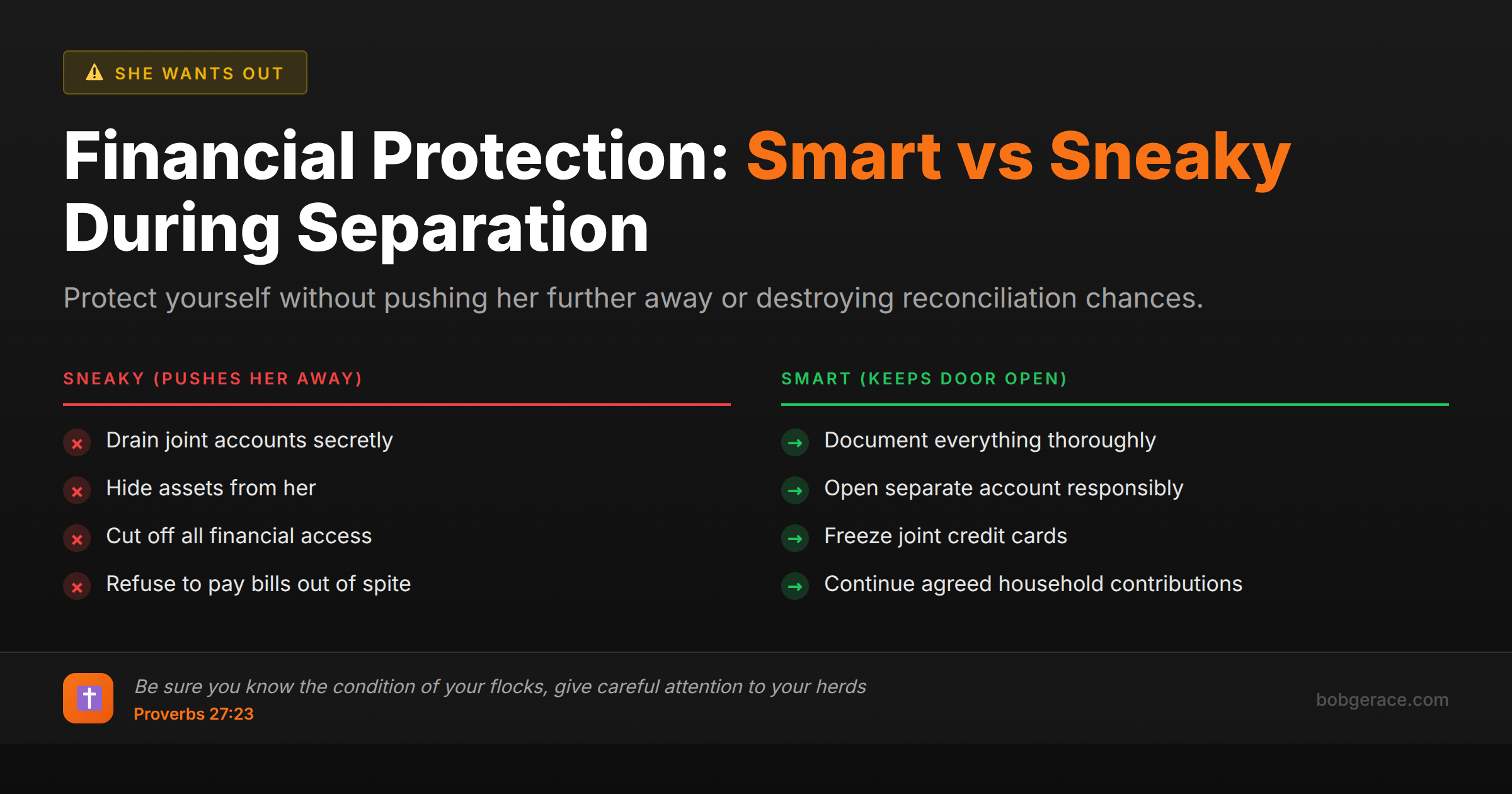

Right now, you need to secure your financial foundation while keeping the door open for reconciliation. Start by documenting everything - bank statements, investment accounts, debts, and assets from the past three years. Open a separate checking account for your personal expenses, but don't drain joint accounts or hide assets. This isn't about being sneaky; it's about being smart. The harsh reality is that separation often leads to divorce, and you need to protect yourself from financial devastation. But here's what most men miss: taking aggressive financial action can actually push your wife further away and make reconciliation harder. The key is being strategic without being vindictive, protective without being controlling.

The Full Picture

Financial protection during separation is a delicate balance between protecting your future and preserving your marriage. Too many men make the mistake of either doing nothing (and getting financially destroyed) or doing too much (and destroying any chance of reconciliation).

Immediate Documentation Needs: • All bank statements from the past 3-5 years • Investment and retirement account statements • Tax returns and W-2s • Property deeds and mortgage statements • Insurance policies (life, health, auto, home) • Business financial statements if applicable • Complete list of debts and liabilities

Common Mistakes That Backfire: Hiding money or assets is not only potentially illegal, but it destroys trust permanently. Draining joint accounts might give you short-term security but hands your wife ammunition in court and kills reconciliation hopes. Canceling her credit cards or access to funds makes you look controlling and vindictive.

The Strategic Approach: Open a personal checking account for your individual expenses, but continue contributing to joint expenses fairly. Freeze joint credit lines to prevent new debt accumulation - this protects both of you. Change direct deposit to your new personal account while maintaining agreed-upon contributions to household expenses.

Protecting Business Interests: If you own a business, get a forensic accountant involved immediately. Document the separation of personal and business expenses clearly. Consider whether you need to buy out your spouse's potential interest or if the business needs additional legal protection.

The Insurance Reality: Don't cancel health insurance coverage for your spouse or children - this creates immediate hardship and legal problems. However, review beneficiaries on life insurance and retirement accounts with your attorney's guidance. Some states have automatic restraining orders that prevent these changes during legal proceedings.

What's Really Happening

From a psychological perspective, financial decisions during separation reveal core attachment patterns and trauma responses. Many men swing between two extremes: complete financial withdrawal (fight response) or total financial control (another fight response). Both strategies typically backfire because they're driven by fear rather than wisdom.

Research shows that financial conflict is both a symptom and a cause of marital distress. When couples separate, money becomes a symbolic battleground for deeper issues like power, control, security, and worth. Men often use financial control as a way to maintain connection or express anger, but this typically activates their spouse's abandonment fears and pushes them further toward divorce.

The Trauma Response Pattern: Separation triggers our primitive survival systems. Your brain interprets this as a threat to your resources and future security, activating fight-or-flight responses that rarely lead to good financial decisions. Some men become hypervigilant about every dollar, while others shut down completely and ignore financial realities.

Attachment Dynamics: If you have anxious attachment patterns, you might use financial generosity to try to win your wife back, potentially compromising your own security. If you lean avoidant, you might cut off financial support as a way to create emotional distance and regain control.

The Integration Challenge: Healthy financial protection requires integrating your emotional needs with practical realities. This means acknowledging your fear and anger while making decisions based on long-term outcomes rather than immediate emotional relief. Men who can demonstrate financial responsibility without weaponizing money often maintain better relationships with their spouses, whether they reconcile or divorce.

What Scripture Says

Scripture provides clear guidance on financial stewardship during difficult seasons, emphasizing both wisdom and integrity. Proverbs 27:23-24 reminds us: *"Be sure you know the condition of your flocks, give careful attention to your herds; for riches do not endure forever, and a crown is not secure for all generations."* This isn't about hoarding wealth, but about being a responsible steward of what God has entrusted to you.

Luke 14:28 teaches practical wisdom: *"Suppose one of you wants to build a tower. Won't you first sit down and estimate the cost to see if you have enough money to complete it?"* During separation, you must honestly assess your financial reality and plan accordingly. This isn't faithlessness - it's biblical stewardship.

1 Timothy 5:8 gives us a non-negotiable standard: *"Anyone who does not provide for their relatives, and especially for their own household, has denied the faith and is worse than an unbeliever."* Even in separation, you have ongoing responsibilities to provide for your family, but this doesn't mean unlimited financial access or control.

Proverbs 21:5 shows the balance we need: *"The plans of the diligent lead to profit as surely as haste leads to poverty."* Rushed financial decisions driven by fear or anger typically backfire. Biblical wisdom calls for diligent planning rather than reactive moves.

Matthew 10:16 provides the framework: *"Be as shrewd as snakes and as innocent as doves."* You can be financially wise and protective while maintaining integrity and transparency. This means documenting everything, securing your interests, and protecting against financial abuse while refusing to use money as a weapon.

Malachi 3:5 warns against defrauding spouses of their wages, reminding us that God sees how we handle financial responsibilities even in broken relationships.

What To Do Right Now

-

1

Gather and copy all financial documents from the past 3-5 years, including bank statements, tax returns, investment accounts, insurance policies, and debt statements

-

2

Open a personal checking account and redirect your direct deposit while continuing to contribute agreed-upon amounts to household expenses

-

3

Freeze joint credit cards and lines of credit to prevent accumulation of new debt that you might be liable for

-

4

Contact a family law attorney for a consultation to understand your state's financial disclosure requirements and automatic restraining orders

-

5

Get current valuations on major assets including real estate, business interests, retirement accounts, and personal property

-

6

Review and document all insurance policies, but do not cancel coverage for spouse or children without legal counsel

Related Questions

Don't Navigate This Financial Minefield Alone

The financial decisions you make in the next 30 days could impact your life for years to come. Get guidance from someone who understands both the legal realities and the marriage dynamics.

Get Strategic Help →